Navigating Legal Fiction and Trust Law

The flip side of reality is titles, symbolised by tails on a coin, reminding us that titles represent legal fiction.

To navigate the system, understand the rules and the roles (titles) we assume. Know which titles serve what purpose.

Grasp how the legal system works, where it offers remedies, and how to use the essential title to achieve debt freedom.

Titles vary: professional (Doctor, Teacher), presumed (Debtor, Parent). Titles are legal fictions that enable commerce between living beings and perpetuities.

Understanding the three certainties of a trust helps reclaim autonomy within the legal framework.

We can help you navigate the complexities of reversing legal personhood agreements or be the only title you need. Start your journey to reclaiming your rights today by exploring our resources or contacting us directly for support.

Three Certainties of a Trust

- Intent: The Settlor’s intention to grant property (res) to a trustee for the beneficiary’s benefit.

- Object: The trustee and beneficiary must be clearly identifiable.

- Subject: The value/res must be identifiable and separate from other assets.

Key Titles and Presumptions

Which title should we hold, and which are we presumed to hold?

- Settlor: The one who grants property.

- Trustee: The one who manages the property.

- Beneficiary: The one who benefits from the trust.

- Res: The property or value held in trust.

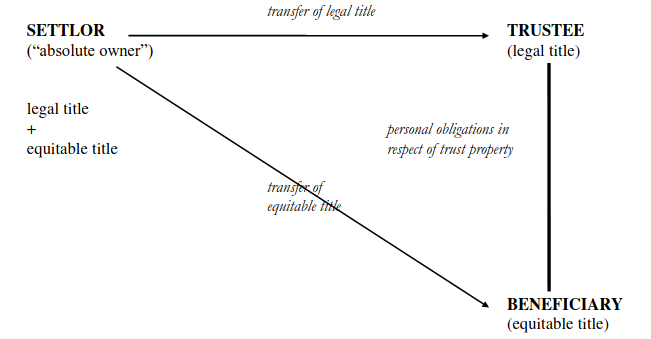

diag. by Alistar Hudson, shows the parties to an express trust.

Definition and Application of Titles in Trust Law

“Kings and Queens have subjects, but in the context of trust law, we must determine our appropriate title.”

Context and Application in English Law

In traditional monarchies, subjects are individuals under the rule of kings and queens. In the context of trust law, the three certainties of a trust are titles such as settlor, trustee, and beneficiary define roles and responsibilities. The “subject” in trust law refers to the trust property (res), which must be clearly identifiable and separate. Understanding your appropriate title in trust law (settlor, trustee, or beneficiary) determines your rights, responsibilities, and benefits within the trust structure. The title “beneficiary” is particularly advantageous, as it entitles one to benefits without the administrative duties of a trustee.

- Settlor: The individual who creates the trust and transfers property into it.

Establishes the trust and defines its terms. - Trustee: The person or entity holding and managing the property for the benefit of the Beneficiary.

Legally obligated to manage the trust in the best interests of the Beneficiary, adhering to fiduciary duties. Can entrust Agents to do its duties. - Beneficiary: The individual or group entitled to the benefits of the trust.

Protected by trust law, which ensures they receive the benefits specified in the trust.

Understanding and correctly identifying your title within a trust is essential for navigating legal obligations and benefits. Beneficiaries, in particular, are often presumed to be the primary focus of trust protections and remedies, highlighting the importance of clear role definition in trust law.

Beneficiary: This is the most advantageous title to own because it allows you to benefit from the trust without the responsibilities of a trustee or the obligations of a settlor. Beneficiaries are shielded from the administrative duties and liabilities that trustees face, and they are the intended recipients of the trust’s benefits.

Unveiling the Federal Reserve: Wilson's Legacy and the Power Shift

Explore the intricate history of the Federal Reserve, Woodrow Wilson’s pivotal role, and the concentration of financial power. Discover how these elements shape modern economics and influence global power dynamics. For a detailed analysis, visit the Newsfeed at Solutions You Need.

Wilson's Legacy: The Global Ripple of the Federal Reserve

Dive into the global impact of the Federal Reserve and Woodrow Wilson’s enduring legacy. Understand how their actions shaped international economics and power structures. Explore the intricate connections, see Newsfeed at Solutions You Need.

Understanding Equity, The Certainties of a Trust and Trust Law

A maxim of equity states that equity acts in personam, meaning we assume a title, a person. By playing the correct role, we can succeed.

Without remedies, injustice is treason. Governments avoid this but use crafty methods. Our actions or inactions lead to presumed consent, making us liable under legal titles. This happens due to misinformation, concealment, and fear-mongering by controllers, coercing us into roles that fit their presumptions. Consequently, we act as trustees, holding legal titles and facing associated liabilities.

Trust Law Essentials:

- A trust has two titles: legal (trustee/agent) and beneficial (beneficiary).

- Trustees have fiduciary duties to beneficiaries.

- Beneficiaries can hold trustees accountable via Data Subject Access Requests (DSAR) under UK legislation.

- Trustees cannot claim against beneficiaries who had no say in agreements.

When an agent makes a claim, challenge it with specific legislation via our DSAR. If the agent fails to answer, it indicates concealment, invalidating the claim. Proper court procedures must be followed, and acting from the beneficial side of the trust evidences no right to the claim, allowing for defense and counterclaim, potentially escalating to criminal jurisdiction for fraud and non-compliance issues.

Call to Action:

Feel like turning things around to how they should be? It is our duty to act.

Money and Trust Law: A Combined Insight

About Money in Commerce: Modern commerce doesn’t use true money, which must be a store of value backed by tangible assets like gold or silver. Current currencies (e.g., £, $) are not backed by these assets, making them “cash” rather than true money. This distinction means there are no real loans or debts, and we cannot truly “pay” for anything.

Cash Creation and Control: Banks create cash out of thin air. When you sign a Credit Agreement for a mortgage or loan, the bank generates this cash in a fictional account and deposits it into your account. You agree to repay this with interest, unwittingly making yourself liable and allowing the bank to potentially seize your property through a Legal Charge. Essentially, you, as the settlor, authorise the creation of cash, which you then receive as the beneficiary. However, through repayments, you become a debt slave, manipulated by fear and misinformation.

Trust Law and Equity: Understanding your title within trust law is crucial. In a trust, the three certainties of a trust as previously mentioned:

- Settlor: Creates the trust and transfers property.

- Trustee: Manages the trust property for the benefit of the beneficiary.

- Beneficiary: Receives the benefits of the trust without management duties.

The legal system often treats individuals as trustees, making them responsible for debts and liabilities, whereas being recognised as a beneficiary is more advantageous, as it entitles you to the benefits of the trust without the associated responsibilities.

Evidence and Examples:

- Legal Framework: The state defines the roles and responsibilities in trust law, ensuring trustees manage trust assets responsibly and beneficiaries receive their due benefits.

- Banking Practices: When you sign a loan agreement, the bank’s creation of money from nothing is a standard practice, as described by various banking policies and economic studies.

By understanding both the modern concept of money and the roles within trust law, individuals can better navigate financial systems and protect their interests. Recognising the distinction between true money and cash, as well as the implications of trust roles, empowers individuals to reclaim their autonomy and make informed financial decisions.

Dealing With Financial and Legal Challenges

Implementation and Defense: These procedures typically take 4-5 weeks to implement, delivering a robust defense and counterclaim if litigation is pursued.

Responding to Threats: Received threats must be countered with a proper Data Subject Access Request (DSAR). Each DSAR must be specific to the matter, adhering to pre-action protocol, which the court will favour if the opposing party persists or you decide to Claim.

Empowerment: Stay one step ahead, lose the fear, and embrace the knowledge to navigate these challenges effectively.

Understanding and correctly applying trust law and financial principles can empower you to handle legal and financial threats, ensuring you are prepared to defend and counterclaim effectively.

Including detailed information for:

Utility Payments: Learn how to use the tear-off Bank Giro Cheque at the bottom of utility statements to pay, conserving your earned cash [request this if needed]. Learn more here

Council Tax: Understand the legality of Council Tax, the process to reclaim payments, and address current or past issues. Discover more here

Penalty Charge Notices (PCN): Differentiate between Council and private company-issued PCNs, and learn how to prove there is no right to a claim. Find out more here

Understanding the System: Gain a deep understanding of the system’s workings, providing context to other modules and how everything ties together. Explore here

Find out more about:

Private Trusts: Looking to protect your assets and provide financial security for your loved ones’ future? We have created an in-depth directions pack that is easy to follow covering all aspects you need to know here.

Almost All Claims are Unenforceable: There are legal processes that must be followed for all claims, there are very few you encounter that are legitimately enforceable. See the differences here

Mobile Homes Unjustly Taxed: There are specific criteria that define what is eligible for Council Tax and there is case law to evidence this, if you are paying this tax while living in a static you should Read here

Legal vs. Law: A Clear Distinction

Legal: Legal pertains to written law, known as legislation, which governs the governors. This is exemplified by the Bill of Rights 1688.

Case Law: Case law, set by precedent, is considered law but is not listed on legislation.gov.uk. It reflects judicial decisions over time.

Agreements: Agreements are binding and considered law for the parties involved.

Crime: Crime is defined as a trespass causing harm, damage, or loss.

Civil Matters: Handled in county courts or chambers, civil matters involve agreements and trust law.

Criminal Matters: Criminal matters involve breaches of agreements made under legal fictions.

Note :

We do not offer legal advice.

Please do your own research before administering your remedy.

We do not claim to have written all content, it has been researched, bought or given.

We do not charge for any content, we ask that you gift us for our time collating the information and to enable further research into the solutions you need.

© 2024 Copyrights Solutions You Need